How to earn 20% on your money (part 3)

- Dec 13, 2019

- admin

- Uncategorized

(Part 3 of a free series on how to earn 20% on your money each year using options. Sound impossible? Former hedge-fund manager and options market maker on the floor of the Philadelphia Stock Exchange proves that it can be done.)

A LITTLE SECRET SAUCE

We have talked about put sales to provide us with income when the stock moves up or sideways. And we have talked about call sales to provide us with income when the stock declines.

We have all the directions a stock can move covered, but how do we identify which options to sell to get us on out way to generating those 20% plus annualized returns?

For that we need to talk a little about the model.

WILL SHE BE WEARING A SWIMSUIT?

Unfortunately, I am not talking about that kind of model.

I’m talking about the option pricing model. Although we are not talking about swimsuit models, we are talking about a model that can help up make some money. And while you may disagree, I find putting cash in my pocket every week kinda sexy. . . Ok so I’m a geek.

Anyway, option traders use a mathematical model to determine the value of an option and what kind of risk they are exposed to as things change. This model was critical to me as a market maker when I would be long and short literally thousands of options in what ever stock I was making markets in.

As a market maker, I used the model to manage risk. As a retail trader, I use it to identify opportunity.

I DON’T LIKE MATH

No worries, we won’t be doing any.

The model was developed by mathematicians who were far smarter than I. You don’t need to do any math, you just need to understand what the math is telling you.

Obviously, since it’s called a pricing model, one of the things it tells us is what the price of an option should be. It also tells us about risk with what are called the Greeks. They tell us how various changes in the stock will affect our position.

I HEAR GREECE IS LOVELY THIS TIME OF YEAR

That may be, but lets stay focused here.

There are five Greeks altogether and we will likely cover them in due course. but I want to focus on the one that is most important to the income generation strategy: THETA.

All else being equal (meaning the stock remains at the same price, interest rates remain the same, etc.), an option is worth less tomorrow than it is today. This is known as time decay and it is exactly what theta measures.

As option sellers we get paid in advance for that sale. We don’t actually get to keep the money until the option expires, hopefully, it expires worthless. Whenever we sell an option, we theoretically have to buy it back. Ideally this occurs at the lowest price possible enabling us to keep as much of what we collected as possible.

Zero is the lowest price we can pay for anything. That would mean the option expired out-of-the-money (OTM), it is worth nothing, and we get to keep the entire premium.

The thing about theta is that it is non-linear. This means that theta changes depending on how much time there is to expiration.

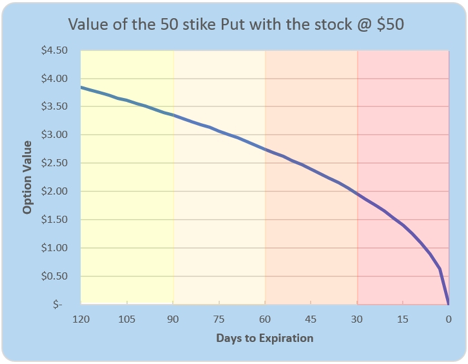

Below is a graph representing the value of a hypothetical 50 strike put option (vertical axis) with the stock always at $50 (all else being equal). The horizontal axis counts down the days to expiration from left to right.

Each shaded area represents 30 days. At the far left of the graph, at 120 to expiration, the option is worth a little less than $4.00. As we move to the right, the value of the option declines, but only slowly at first.

At the 30 day mark, the option is worth about $2.00. So, over the first 90 days the value of the option declined by a little less than $2.00. Over the final 30 days, the value of the option declines from $2.00 to zero. I would much rather collect $2.00 in 30 days than have to wait 90 days for that same $2.00. That rapid decay is exactly what I want to capture as an options seller!

PUTTING IT INTO PRACTICE

Once again, I find the easiest way to explain this is to share some of my recent income producing trades.

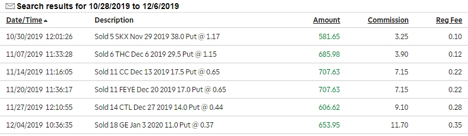

Below are the last half dozen trades I have done using this powerful strategy. In the first column you can see the day I entered the trade.

In the second column you can see the number of contracts I sold, the stock symbol, the expiration date, the strike price, and the price of the option sold.

Each trade has a life of 30 days or less, from entry to expiration. This allows me to capture the greatest and fastest time decay. Additionally, each trade is generating at least a 3% return on the capital required to hold the position.

This is the secret sauce to managing this portion of my portfolio:

- Identify a stock that I am willing to own and the price I willing to pay (the strike price) to own it.

- Target a 2-4% return on each trade.

- Make use of weekly options so that I have cash flow each week.

- Maintain diversification across my open positions. (We will talk more about that next time.)

- SIT BACK AND GET PAID!

While you may not be ready to identify these opportunities on your own, once Dylan turns me loose, I will be sharing the income producing trades that I make each week!

Ed Pawelec

Guest Contributor,

Behind the Markets