How to Earn the Income You Need for Retirement (Part 2)

- Dec 06, 2019

- admin

- Uncategorized

(Part two of a free

series by Ed Pawelec, a former hedge-fund manager and options market maker on

the floor of the Philadelphia Stock Exchange)

Last week we took the first step in you, personally, outperforming 90% of

professional money managers.

Selling select options can put you in a position to potentially generate

returns of better than 20% on an annualized basis and put cash in your account every

week. That would put you in the elite among money managers without having to

pay their egregious fees.

The best managers have a plan (although I have known quite a few who don’t). We

have talked about step 1 of the plan: selling puts, but I need to explain the

rest of the it for you to truly understand and capitalize on this unique

opportunity.

So, let’s recap last week and get you started with Part 2.

RECAP – PUTS

Stocks can do 1 of 3 things over a given time frame. They can go up, down, or

sideways.

Finding a stock that is either 1: likely to move higher or 2: at least move

sideways, is the first step. That gives you 2 out of 3 ways to win. Once you

have identified a candidate you can sell a put against that stock.

When you sell a put you get paid a premium which goes right into your brokerage

account. You get to keep that premium if the stock goes up or sideways and, in

most cases, that is the end of the story. (Although at least once a month you

have to buy drinks!)

However, there is always the 3rd possibility that the stock

goes lower. In that case you will own the stock. Remember, selling a put will

obligate you to buy the stock if, on expiation, the stock is below the strike

price of the put you sold.

This is not a bad thing. It simply means that we move to Part 2 of our income

generating strategy: the covered call.

A COVERED WHAT?

A call is the counterpart to a put. A call option is a contract that gives its

owner the right to buy a stock at a specific price (the strike price) within a

specific time period (the expiration date). The value of the call is derived

from the price of the underlying stock and how much time you want to own that

right to buy.

| CALL OPTIONS | |

| Buyer | Seller |

| Owns the RIGHT to buy stock at the strike by the expiration. | Has the OBLIGATION to sell stock at the strike by the expiration. |

| Buyers can exercise their rights. | Sellers can be assigned on their obligations |

| Pays a premium for the option. | Collects a premium for the option |

| One way to win: stock must go up to make money. | Two ways to win: stock goes sideways or lower to make money. |

If you were bullish on a particular stock, meaning you were expecting the stock to go higher, you might buy a call option. The higher the stock price goes, the more valuable the right to buy becomes. It costs money to buy a call and if the stock doesn’t go up, you could lose some or all of that cost or premium.

It stands to reason that if you buy any option, call or put, and you have to pay something, then the person who sold that option gets paid that something. If we were assigned on the put we sold earlier, then we would look to sell calls against that position, continuing to generate income.

Remember last week I said (and I’ll say it again) in big bold letters: IF YOU DO NOT HAVE SUFFICIENT FUNDS TO BUY THE STOCK, YOU SHOULD NOT MAKE THE TRADE!

Owning the stock is potentially part of the strategy. It’s not a bad thing, but you have to be prepared, in terms of cash on hand, to buy the stock.

Now we own the stock and are selling a call against that position. That’s what makes it a covered call; we own the stock that we might be obligated to sell. Perfect!

THE STRATEGY AT WORK

The easiest way to explain the process is to use an example from my own brokerage account from earlier this year. These trades were in The Chemours Company (CC).

You can also see where the stock was when I made the trades on the graph below.

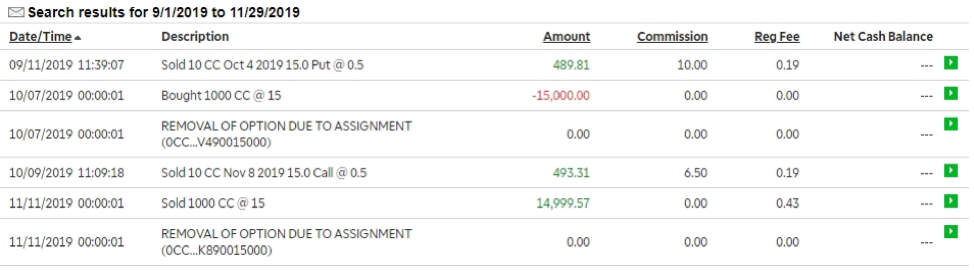

On September 11, I sold 10 of the 15 strike puts, expiring October 4, for $.50.

After commissions, I collected $489.81.

(That money goes directly into my account and in order to maintain this position as a cash covered put I have a capital requirement of $14,510.19 ($15,000 for 1000 shares of a $15 stock less the premium collected).

On October 4, the stock closed at $13.27 which was below the 15 strike. I was assigned on those puts and purchased 1000 shares at $15. The stock actually goes into your account on the Monday following the Friday expiration. That is why the transaction date on the stock is October 7.

Importantly, I had the $15,000 available to cover the cost of the purchase. This is what makes the trade a cash covered put. While in many cases you will not actually need to use the cash, you should always have sufficient capital on hand for situations where you are required to purchase the stock.

On October 9, I sold 10 of the 15 strike calls, expiring November 8, for $.50.

After commissions, that was another $493.31 coming directly into my account.

Just because I now owned the stock doesn’t mean that I can’t continue to generate income. By the time November 8 rolled around, the stock was well above $15 and I was assigned on my calls, selling the stock at $15.

Obviously, had I waited a few more days or a week, I could potentially sold a higher strike, maybe the 16 or 17 strike, for a similar value of $.50. In that scenario, not only would I have collected premium on the sale of the put and the call, but I would have further enhanced my return with a gain of a dollar or two on the stock.

But that is not the point and it is not relevant to the plan.

First, as much of genius as I am ?, I really don’t know where the stock is going to go on any given day or week. That’s why I stick to the plan.

Second, the goal of this strategy is to generate income and that always needs to be the focus. If I buy and sell the stock at the same price, it doesn’t matter. I am generating income at every opportunity.

In some situations, I may even take a small loss on the stock. But the premium I collect should more than offset that.

Think about it this way –

(1) I had roughly $15,000 in capital tied up, either in covering my put sale or in actually owning the stock, for 58 days.

(2) During that time I collected a total of $983.25 in premium. That is a 6.5% return in less than 60 days!

If I could generate that return every 60 days, I would end up with a nearly 40% return over a year!

THE THIRD OUTCOME

The beautiful thing about this part of the strategy is that it takes care of the third outcome.

When I sell a put, I make money if the stock goes sideways or up. When I add the covered call to the overall income strategy, I can make money even if the stock goes down! Up, down, and sideways, there aren’t any other possibilities.

This is what makes this strategy so powerful. It is something that I do on a regular basis and I am happy to share it with you.

No one cares more about your money than you. When you have an opportunity to outperform money managers, who claim to have your best interest in mind, why wouldn’t you take advantage!

Until next time,

Ed Pawelec

Guest Writer,

Behind the Markets