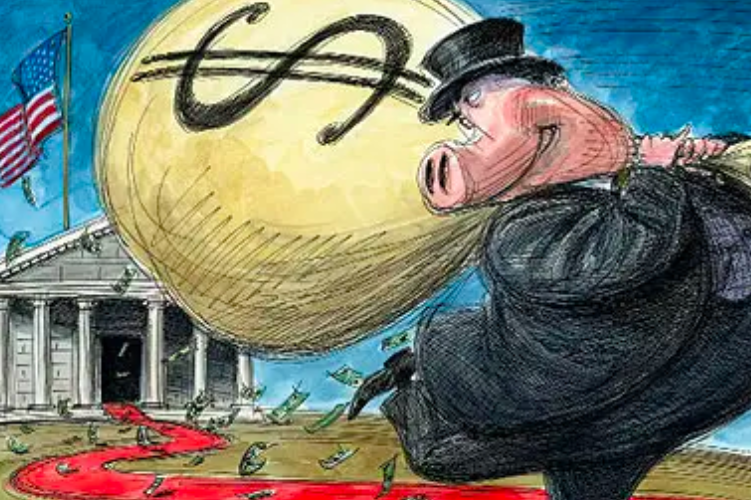

How to Rob an Individual Investor

- Nov 30, 2018

- admin

- Uncategorized

(Dylan is off today preparing a free report for you on the marijuana industry next month. Below is an article originally published 2007 and updated this February to include cryptocurrencies.)

THE RICH HAVE BEEN DOING IT TO THE POOR SINCE THE BEGINNING OF TIME.

Fortunately for us, it’s a heck of a lot more blatant (and therefore easier to spot) on Wall Street than it is in many places.

Some call it a “hustle”. Others call it a “con job”. Whatever your pet name for it is, one thing is certain: if you don’t see it coming, you’ll likely wind up much poorer as a result and very, very sorry you ever ran into it.

On Wall Street, as opposed to Main Street, the con takes a couple of different shapes. One is the famous and well discussed “bucket-shop hustle”.

Now, many people automatically think of small, dingy firms – akin to a boiler room – when they hear the name “bucket-shop”. But those firms are responsible for a small fraction of the damage done to individual investors. To this very day, the most harmful “bucket-shop” practices are engaged in by many of the largest brokerage firms in the world.

It goes a little something like this: you get a call from a well-intentioned broker who has the “deal of a lifetime” for you. After getting you all worked up into a lather, you’re convinced that it’s something you should purchase.

What you don’t know is that the broker who just convinced you to buy shares of XYZ was secretly selling them for one of the firm’s largest customers.

Before you know it, you’re left holding shares of a stock or bond that have decreased in value by as much as 90%.

The “commission cartwheel” is another variation of the same hustle. The only thing that changes is that, instead of asking you to buy a stock that somebody else is selling, you’re asked to purchase shares in a stock that gives the salesman an extraordinarily large commission.

What’s particularly damaging about this little hustle is that it comes in forms that most people couldn’t imagine.

Sure, some folks expect to get hustled when buying shares of a stock. But oftentimes, people practicing the “commission cartwheel” hide their hustle behind otherwise innocent sounding securities such as bonds and mutual funds. Yikes!

And of course, let’s not forget the traditional classic, the “pump and dump”.

In its older incarnations, investors get called to buy a stock that is secretly being liquidated by the owners of the firms (as opposed to large clients of the firm).

For example, you get a call to own shares of XYZ for $2 per share. What you don’t know is that the firm calling you had an investment banking relationship with the company and is selling the shares allotted to them at sometimes pennies per share.

So every time you purchase 1,000 shares of stock, you are really making the firm an “investment banking” profit of $1,998 if the bank owns the shares at $0.02 each.

These days, the classic “pump and dump” has taken on a new and much hipper flavor with the use of email. This new and improved “electronic pump and dump” does largely the same thing, but via email instead of phone calls.

I can’t tell you how many friends of mine – largely smart and successful people – shoot me the occasional email asking my opinion on a stock they’ve just been given the greatest tip about.

I don’t even respond any longer if the symbol ends in the letters “.PK” denoting a pink sheet security. If they don’t know to beware of those types of advertisements at this point (after years and years of my warnings), then nothing I can say will change that.

Last but not least, there is another classic Wall Street hustle that I’ve failed to mention so far.

Of all the hustles I’ve discussed, it is by far the sleekest and smoothest. In fact, it’s such a smooth and silky hustle that it isn’t even illegal! But make no mistake about it – it’s just as dangerous (if not more so) than the rest of them.

We’ll refer to it as the “IPO-cicle” and it goes a little something like this:

When a specific industry group has a great run – say 5 or 10 years of excellent business conditions – the founders cash in by selling their stock thru an IPO (initial public offering) at the very top of the market.

For example, at the end of the last bull market – for the first time in history – private equity firms of all stripes went public. That was largely a result of the success (or the illusion thereof) of Blackstone’s IPO.

Why on earth did these otherwise greedy private equity mavens want to suddenly sell shares to the investing public? Did they suddenly grow a conscience and want small investors across America to make some great money owning their shares?

Of course not!

What they were saying to themselves is that we’re at the top of a bubble in private equity. With low interest rates, a business-friendly administration and a low tax environment, things are simply never going to get this good ever again.

So they cashed out. Right at the peak of the private equity bubble, when small investors who don’t understand the cyclical nature of things are at their most fascinated by the billions of dollars they’re making.

Right now, replace “IPO” with “ICO” (initial coin offering) and you can see a replay of the same events.

Of course, in this case the industry group on the heels of a great run is that of cryptocurrencies.

But everything else is the same: low interest rates, a business-friendly administration, and the peak of the equity market.

So people rush to cash in on the high prices of cryptocurrencies by taking their coins “public.”

With all the similarities, however, there is one odd difference:

It makes sense for the buyer of a stock to want the price to rise on the day of its initial public offering…

But it’s strange that a buyer of cryptocurrencies would want the price of the currency to rise on the day of its offering.

In fact, if cryptos were in fact real currencies, the last thing you would want them to do is trade higher on their offering.

Why?

Because nobody would want to use them as a currency!

Why use your cryptocurrency to buy something when you can hold it and watch the price go higher every day???

Yes, I’ve seen all types of hustles in my day.

But they all have one thing in common: they’re great at separating people from their money!

Dylan Jovine