Yesterday’s Market Drop Didn’t Even Make the Top 20 List

- Feb 06, 2018

- admin

- Uncategorized

How bad was yesterday’s 1,175.21 point loss?

With just a 4.6% decline, the largest point drop in Wall Street history didn’t even make the top 20 list of the largest percentage losses of all time.

Why did the stock market go down so much yesterday?

Two charts I want to show you.

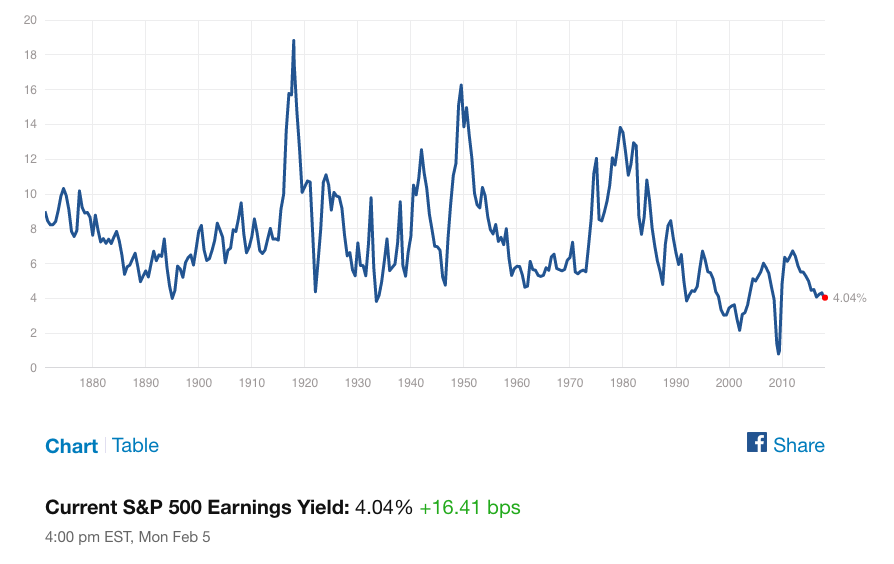

The first chart is called the S & p 500 Earnings Yield Chart.

The S & P 500 Earnings Yield Chart

This chart let’s you imagine how what kind of yield you would get if you could afford to buy the entire S & P 500.

That’s right. If you had appx. $27,639 trillion dollars (that’s “trillion” with a “T”), than then you could buy out the entire U.S. stock market.

But what would spending all that money get you?

All the earnings of all the companies in the U.S. stock market approximate add up to $1.2 trillion dollars.

That’s about 4.4%.

In other words, if you bought out every company in the S & P 500, you would get about 4.4% on your money in actual earnings. (Earnings, as in money paid to you at the end of the year that you put on your taxes).

The second chart is the US 10-Year yield chart.

This chart shows what the U.S. government pays you when you buy a 10-year U.S. treasury bond.

As you can see below, as of this writing, the U.S. government is paying investors 2.73% to loan them money for 10 years.

10-Year U.S. Government Bond Yield

Let’s compare the two:

When looking to invest their money, sophisticated investors compare everything against the yield they would get buying a 10-Year U.S. government bond.

Why?

Because that’s what equity investors call the “risk- free rate of return.”

In other words, investors know they can buy 10-year U.S. bonds and get paid 2.73% with absolutely zero risk.

So, every investment decision we make has ought to be compared to the risk- free rate of return that the U.S. government is offering.

The Reason the Stock Market Went Down

Now, the reason the market has been going down is that folks are comparing that 2.73% risk-free yield being offered by the U.S. government with the 4.04% yield being offered by the stock market.

And they’re saying to themselves, “I’d rather get a yield of 2.73% that is absolutely risk-free than one of 4.04% in the risky stock market.”

In the eyes of many investors, the stock market was not paying enough of what we call an “risk premium” to invest in it.

Where do we go from here?

That’s a conversation for another day..